Organizing expert Dr. Regina Lark calls this phenomenon “The Great Stuff Transfer.” As a result, many Florida families find this transition emotionally and logistically overwhelming.

We are not just transferring wealth. We are transferring volume – boxes, furniture, collections, keepsakes, and with them, decades of memories.

From a Florida estate planning perspective, handling “all the stuff” thoughtfully can reduce stress, avoid family conflict, and even simplify probate administration.

Why This Is So Emotional

For many parents, belongings represent identity, sacrifice, and history. Wedding china, Hummel figurines, baseball cards, or record collections may hold deep sentimental value – even if they have little market value today.

For adult children, receiving these items can feel like an obligation rather than a gift. Downsized homes, frequent moves, and changing lifestyles mean younger generations often value flexibility over accumulation.

It is not disrespect. It is generational reality.

A Florida Legal Perspective: Why Planning Matters

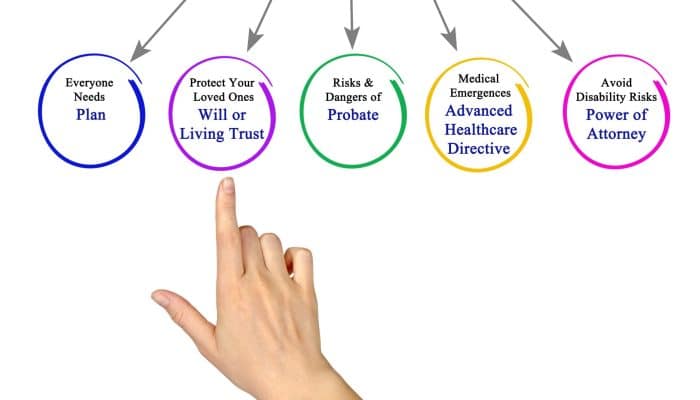

In Florida, tangible personal property – meaning furniture, jewelry, household items, artwork, collectibles, is typically handled through:

- A specific bequest in a Last Will

- A separate written personal property list (authorized under Florida law)

- Or distribution by the Personal Representative during probate

If there is no clear direction, disagreements can arise. Even small items can create tension among siblings.

Planning ahead reduces:

- Confusion

- Hurt feelings

- Probate delays

- Family disputes

For Parents: Plan While You Can Participate

If you are in good health, now is the best time to start the conversation.

- Start With Curiosity

Ask your children what they actually want. You may be surprised, and that is okay. - Preserve the Story, Not Just the Object

Take photographs of meaningful items and write short captions about why they mattered. A digital archive can preserve the memory without requiring someone to store the physical item. - Curate, Do not Accumulate

Keep what truly brings joy or meaning. Let go of items that no longer serve a purpose. Many mass-produced items simply do not hold resale value today. - Downsize Proactively

Making decisions together – before a health crisis – gives everyone clarity and control.

For Adult Children: Set Boundaries Without Guilt

Receiving the contents of a home can be overwhelming. It is important to remember:

- You are not rejecting your parent by declining certain items.

- Keeping one meaningful piece can be more powerful than keeping ten out of obligation.

- Love and legacy are not measured in storage units.

Being honest now prevents resentment later.

Practical Steps That Make a Difference

Gift Items During Lifetime

Instead of waiting for probate, consider gifting meaningful objects now. Include a note explaining why the item is special.

Use a Personal Property Memorandum

Florida law allows a separate signed list to distribute personal items without rewriting the entire Will. This provides flexibility and clarity.

Consider Donation Plans

If heirs do not want certain items, parents can specify charities or organizations for donation. Many Florida charities welcome furniture, clothing, and household goods.

Consider Professional Help

Professional organizers, estate sale professionals, or neutral third parties can help facilitate difficult conversations.

Probate Considerations in Florida

After death, the Personal Representative is legally responsible for safeguarding and distributing personal property. Without clear direction, this process can:

- Delay estate administration

- Increase legal costs

- Create sibling disputes

- Lead to court involvement

Advance planning minimizes those risks.

Legacy Is More Than Objects

At its heart, The Great Stuff Transfer is about values, not valuables.

The goal is not preserving every dish or figurine. It is preserving stories, traditions, and family connection.

With thoughtful conversations and proper estate planning, Florida families can navigate this transition with clarity, respect, and peace of mind.

If you would like guidance on updating your Last Will & Testament, creating a personal property memorandum, or structuring your estate plan to avoid conflict, consulting a Florida estate planning attorney can help ensure your legacy is passed forward – not your clutter.

The foregoing is a brief and general overview of the topic and the need for specific and experienced legal and tax advice is emphasized.

If you have any additional questions regarding the foregoing or have any legal issues or concerns, please contact the law firm of CASERTA & SPIRITI in Miami Lakes, Florida.