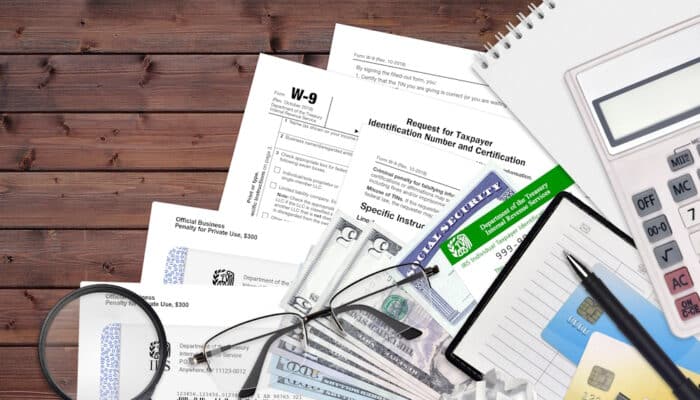

Keeping important documents organized and secure is crucial for protecting a Florida resident’s financial and personal information. Here is a breakdown of eight essential documents a person should never discard:

1. Personal Papers

- Examples: Birth certificates, Social Security cards, marriage licenses, military records, and divorce decrees.

- Why Keep Them: These documents are often required for significant life events like getting a passport, renewing a driver’s license, or proving one’s identity. Make copies and store the originals in a safe, secure location.

2. Bank Account Records

- Examples: Canceled checks, bank statements, and receipts.

- Why Keep Them: Maintain these records until one’s account statements are received and reconciled. Keep checks and receipts related to significant purchases or tax matters longer for future reference.

3. Investment Records

- Examples: Trade confirmations, investment statements.

- Why Keep Them: Keep these for at least six-seven years after an investment is sold. They help an individual track capital gains and losses and are essential for accurate tax reporting.

4. Credit Card Statements and Documents

- Why Keep Them: Retain statements and receipts until they are reconciled with one’s statements. Keep receipts for major purchases or tax-related expenses longer, especially if one might need to return the item or for warranty purposes.

5. Loan Records

- Examples: Documents for car loans, mortgages, and other debts.

- Why Keep Them: These records serve as proof that loans have been paid off. In the event of a dispute with a creditor, a person will have documentation to prove their payments and avoid potential legal issues.

6. Rental Agreements

- Why Keep Them: Store rental agreements for at least seven years after the lease ends. This ensures one has a record of their tenancy, which can be crucial if disputes arise regarding property condition or deposit returns.

7. Insurance Policies and Related Documents

- Examples: Health, auto, home, and life insurance policies.

- Why Keep Them: Retain health insurance policies until the coverage ends but keep other insurance documents for at least six years after cancellation. These records may be necessary if you need to file a claim or dispute coverage.

8. Tax Returns and Related Documents

- Why Keep Them: Tax documents should be stored for at least seven years, as this is the time frame in which the Internal Revenue Service (IRS) can audit your returns. Without these records, an individual could face penalties or additional scrutiny from the IRS. However, the IRS has ten years to collect unpaid tax debt. After that time, the debt is wiped clean from the IRS books and the IRS writes it off. This period is called the Ten-Year Statute of Limitations. It is not in the financial interest of the IRS to make this law widely known. In normal circumstances, the IRS is permitted by law to go back three years when auditing tax returns. Nonetheless, if errors are detected in a return, the IRS can go back even further, although they usually do not go back more than six years.

Takeaway

Organizing and retaining these critical documents can prevent identity theft, financial loss, and legal complications. As a general rule, keep these records secure, consider maintaining digital copies, and shred outdated documents that contain personal information to protect against identity theft.

The foregoing is a brief and general overview of the topic.

If you have any additional questions regarding the foregoing or have any legal issue or concern, please contact the law firm of CASERTA & SPIRITI in Miami Lakes, Florida.